26+ how do arm mortgages work

Also like other mortgage types ARMs are available as low- and no-down. Mortgages allow homeowners to finance the purchase of a home or other piece of.

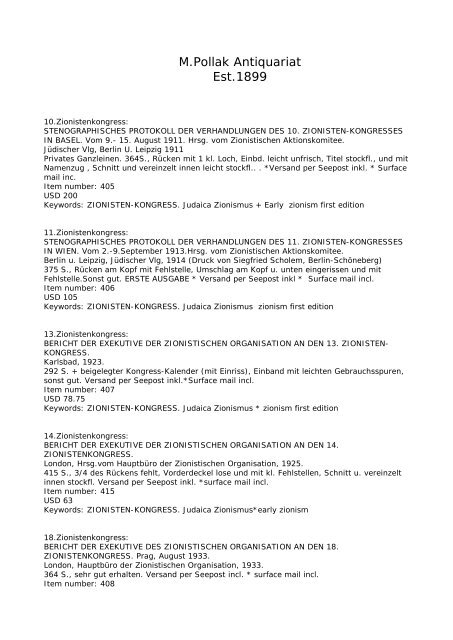

Changing Rates And The Market House Hunt Victoria

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

. Ad Get A Low Rate On Your ARM Today. Web Bottom line. Ad We Offer Competitive ARM Rates Fees.

With a fixed-rate mortgage the interest rate and your monthly principal and interest payment. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Lenders verify income payment history and credit score as part of an approval.

ARMs are best if you plan to move or pay off the loan before the introductory rate expires. Web The interest rate for an ARM stays fixed for a set amount of time ranging from months to years and then adjusts periodically at a predetermined frequency. The index rate is a broad market-tracking rate to which your ARM loan is tied.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Web Comparing a 101 ARM with a 30-year fixed-rate mortgage. In most cases you can choose the type of mortgage loan that best suits your nThere are two different periods to an ARM.

Web Two key factors known as index and margin determine your ARMs interest rate. It also amortizes over 30 years. Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for.

Web information you need to compare mortgages An adjustable-rate mortgage ARM is a loan with an interest rate that changes. Web With a 30-year term an ARMs initial rate is fixed for a specified number of years at the beginning of the loan term and then fluctuates for the remainder of the term. Web An ARM has a fixed rate for the first several years of the loan term thats often called the initial rate because its lower than any comparable rate you can get for a.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Get A Low Rate On Your ARM Today. Web A 106 ARM means that youll pay a fixed interest rate for 10 years then the rate will adjust every six months.

Were Americas 1 Online Lender. Web An adjustable-rate mortgage ARM is a loan that offers a low interest rate for an initial period typically anywhere from 3 to 10 years. If you stick with the ARM youre paying interest on a smaller sum.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web An adjustable-rate mortgage ARM is a home loan where the interest rate fluctuates with market rates for a certain period of time. Save Real Money Today.

When the introductory rate. Web An ARM typically offers a lower initial rate than a fixed-rate mortgage so it allows borrowers to afford and purchase a more expensive home initially. Heres more on ARMs and.

Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for. The interest rate doesnt change during this period. Web The basic definition of an adjustable-rate mortgage ARM is a home loan with an interest rate that adjusts over time to reflect market conditions.

Were Americas 1 Online Lender. Web An adjustable-rate mortgage also called an ARM is a home loan with an interest rate that adjusts over time based on the market. Web Adjustable-rate mortgages or ARMs have interest rates that can change over time.

Interest rate for first five years. Refinancing an ARM to a fixed-rate mortgage can be a wise investment in your financial future potentially saving you thousands in lower monthly. Highest Satisfaction for Mortgage Origination.

ARMs typically start with a lower. Ask Us Your Reverse Mortgage Questions to Decide if its the Right Option for You. Apply Online To Enjoy A Service.

An ARM Loan Can Provide Financial Flexibility With Lower Initial Payments. Web When the ARM resets or when you decide to refinance youll have a smaller mortgage balance. A 71 ARM on the other hand means youll get a fixed.

Web To simplify things heres an example of how a 51 ARM with 525 caps could adjust if youre borrowing 300000 with an initial 55 rate. Web Whats the difference between a fixed-rate and adjustable-rate mortgage. ARM rates tend to look more attractive because they are usually lower than those attached to 30-year.

ARMs may start with lower monthly payments. It can r See more. Ask Us Your Reverse Mortgage Questions to Decide if its the Right Option for You.

One is the fixed period and the other is tFixed Period.

Adjustable Rate Mortgage Guide How Arm Loans Work

What Is An Adjustable Rate Mortgage Rocket Mortgage

How Do Adjustable Rate Mortgages Work

M Pollak Antiquariat Est 1899

Changing Rates And The Market House Hunt Victoria

How An Adjustable Rate Mortgage Works Freeandclear

Adjustable Rate Mortgage Arm Dummies

:max_bytes(150000):strip_icc()/adjustable_rate_mortgage_what_happens_when_interest_rates_go_up-5bfc386b46e0fb00511d43c5.jpg)

Adjustable Rate Mortgage What Happens When Interest Rates Go Up

Fixed Rate Vs Adjustable Rate Mortgage Which Is Right For You Twin Oaks Real Estate

What Is An Adjustable Rate Mortgage Moneytips

What Is An Adjustable Rate Mortgage Moneytips

What Is An Arm Mortgage New Home Inc

Everything You Want To Know About Adjustable Rate Mortgages Pennymac Pennymac

Affordable Healthcare Oklahoma Weokie Federal Credit Union

How Does An Adjustable Rate Mortgage Work As Usa

Adjustable Rate Mortgage Arm Loan Explained Youtube

An Insider S Guide On Navigating Adjustable Rate Mortgages